The Web3 industry is exploding, and investors are flocking to get a piece of the action. With so many new projects and platforms popping up all the time, it can be challenging to identify which investments are most likely to succeed. This is where Artificial Intelligence (AI) can be a game-changer.

AI algorithms can analyze vast amounts of data and provide insights into the potential success or failure of Web3 investments. By leveraging machine learning and natural language processing, AI can scan through news articles, social media posts, and other sources to identify patterns and trends that may impact the value of a particular investment.

For example, a new Web3 project may be generating a lot of buzz on social media, but negative sentiment about the project’s development team could indicate potential issues down the road. AI can flag this sentiment and alert investors to potential risks.

In addition, AI can analyze market data and historical trends to identify potential risks and opportunities. For instance, an AI algorithm might notice that a particular project is performing well in a certain market segment but is lagging behind in another. This insight could help investors make informed decisions about where to allocate their funds.

One real-world application of AI in Web3 investment analysis is the platform Predictr. Predictr uses machine learning algorithms to analyze market trends and news articles related to various Web3 projects. The platform assigns a score to each project based on its perceived risk and potential return on investment. Investors can use Predictr’s insights to make informed decisions about which projects to invest in.

Another example is ChainGuardian, a platform that uses AI to monitor blockchain transactions and detect fraudulent activity. ChainGuardian’s algorithms analyze transaction data in real time and flag any suspicious activity, such as unusually large transactions or transactions involving known bad actors. This can help investors avoid potential scams and fraudulent projects.

AI can also monitor the performance of a particular investment in real time, providing alerts when significant changes occur. For example, if a particular project’s token value suddenly drops, an AI algorithm can quickly flag this and alert investors to potential risks.

But those official programmes are not the only examples. ChatGPT, using the correct plug-ins or the paid version allows you to introduce some variables in the algorithm to bypass the product limitations by default, obtaining easy insights about investment, though, they will be always biased by overall internet data workflow.

Furthermore, AI can help investors diversify their portfolios by identifying emerging trends and promising new projects. For instance, an AI algorithm might notice that decentralized finance (DeFi) projects are gaining traction and recommend that investors allocate more funds to DeFi projects.

AI has the potential to revolutionize Web3 investments by providing valuable insights and predictions that can help investors make informed decisions. As the industry continues to evolve, we can expect to see even more innovative uses of AI in investment analysis and decision-making. The savvy investor of the future will undoubtedly rely on AI-powered platforms and tools to make smarter investment decisions.

We believe AI-powered investment analysis tools will not necessarily destroy the profession of traders or render novice investors obsolete. While AI can provide valuable insights and predictions, it is ultimately up to the investor to make decisions based on that information.

Traders and investment professionals can still use their expertise to interpret and contextualize the data provided by AI algorithms and make informed decisions based on their knowledge of the market and the investment landscape. Moreover, AI algorithms are not infallible and can make mistakes, so human oversight and decision-making will still be essential.

For novice investors, AI-powered investment analysis tools can be helpful tools for making informed decisions and managing their portfolios. However, it is still essential for these investors to have a basic understanding of the market and the investment landscape, and not rely solely on the insights provided by AI algorithms.

To sum up, AI-powered investment analysis tools will be a valuable resource for both traders and novice investors, but will not replace human expertise and decision-making entirely. Instead, these tools will augment human intelligence and help investors make more informed and profitable investment decisions.

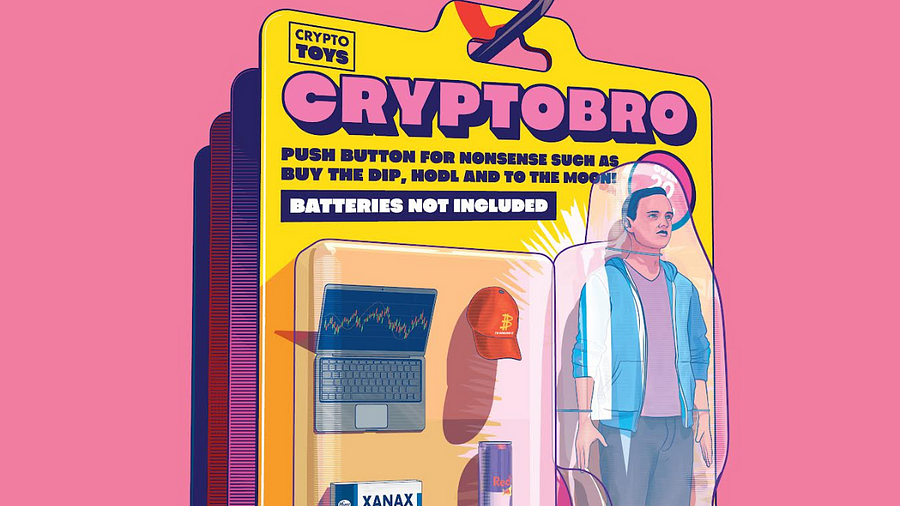

Regarding the cryptobros, well, they should forget about selling courses to non-Web3 savvies, given that all the information is already available making a few questions to the most known AI platforms, which implicates an ending to one of the most polemic circumstances surrounding crypto: Influencers with no technical knowledge scamming their followers.

Keen to learn more?

Read the Nova Miningverse Whitepaper

Stay close: Telegram | Nova Miningverse Twitter | LinkedIn | Website | YouTube | Discord